Can't make the payment on your Wichita home? Here's one option for you!

Underwater on Your Mortgage? Here’s a Plain-English Guide to Short Sales

If you owe more than your home is worth, you’re not alone—and you do have options. This is general information, not legal/tax advice. Talk with a qualified attorney/CPA about your specific situation.

What is a short sale?

A short sale is when your lender agrees to let you sell your home for less than the total amount you owe, and accepts the sale proceeds as full (or negotiated) satisfaction of the debt. You still sell the home on the open market with a real estate agent, but closing is contingent on lender approval.

Why lenders say yes: a market sale they can control (with an actual buyer) often costs less and finishes faster than foreclosure.

Is a short sale right for me?

You’re a strong candidate if most of these are true:

-

You’re underwater (market value < loan payoff + selling costs).

-

You’re facing a hardship (job loss, medical, divorce, death, payment shock, relocation, etc.).

-

You can’t afford the payments or a realistic workout.

-

You can provide documentation: bank statements, pay stubs, tax returns, and a hardship letter.

-

You’re willing to keep the home show-ready and cooperate with showings while we work with the lender.

Even if you’re not behind yet, some lenders will review a short sale when there’s a documented hardship. Ask—don’t assume it’s a no.

Pros & Cons (quick scan)

Pros

-

Avoids foreclosure and the public auction process

-

Often less credit damage than foreclosure

-

You control the marketing, timing, and buyer selection (with lender approval)

-

Possible deficiency waiver and/or relocation assistance (varies by lender and file)

Cons

-

Not instant: lender review can take 4–12+ weeks after you have an offer

-

You must disclose finances and hardship to the lender

-

Credit report can show “settled for less than full balance”

-

Tax implications are possible if any debt is forgiven (1099-C)—speak with a CPA about current rules and potential exclusions for primary residences

How the process works (step by step)

-

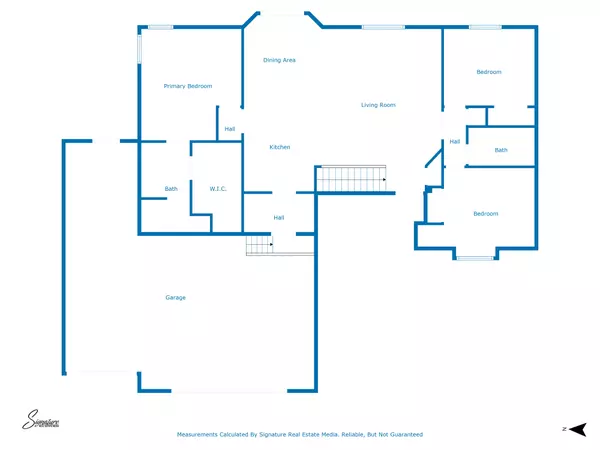

Reality check & pricing plan

Your agent prepares a market valuation + net sheet to confirm you’re underwater and estimate final proceeds. -

Call the lender’s loss-mitigation department

Ask what short-sale package they require and whether any deadlines apply. Request written instructions. -

Hire an experienced short-sale agent (and loop in an attorney/CPA if needed)

You’ll sign an authorization to release information so your agent can speak with the lender on your behalf. -

List the home “subject to lender approval”

We market aggressively to attract a strong, clean offer (the lender will do a BPO/appraisal to verify value). -

Assemble & submit the short-sale package (your agent helps)

Typical items:-

Hardship letter (see template below)

-

Last 2 months bank statements & pay stubs

-

Last 2 years tax returns / 4506-C (if requested)

-

Listing agreement, purchase offer, buyer pre-approval/POF

-

Preliminary settlement statement/net sheet

-

HOA info, payoff statements for all liens (second mortgage, HELOC, judgments, HOA)

-

Arms-length affidavit (you can’t sell to a family member/insider unless allowed by lender)

-

-

Lender review & valuation

The lender orders a BPO/appraisal. They may counter the price or request concessions (e.g., from you, the buyer, or agent) to meet their net target. -

Approval letter & terms

When approved, the lender issues a letter stating:-

Approved sale price & net

-

Expiration date of approval

-

Whether the deficiency is waived (critical!) or if they require a contribution/promissory note

-

Any relocation assistance offered

-

-

Close

Title is transferred to the buyer; proceeds go to liens per the approval letter. Keep copies of all final documents for your tax/credit files.

Credit & buying again later

Expect some credit impact (late payments + settled account). Many buyers can qualify for a new mortgage in ~2–4 years after a short sale depending on loan type, credit re-establishment, and guidelines at the time. Your loan officer can give current wait-period rules.

Common roadblocks—and how we solve them

-

Multiple liens (2nd mortgage, HOA, judgment): We obtain payoff approvals from each lienholder; all must agree to the final net.

-

Mortgage insurance (PMI): The PMI company may require extra paperwork or a contribution—plan for negotiation.

-

Value disputes: If the lender’s BPO is high, we submit a value rebuttal with better comps and condition photos.

-

Tight closing window: Approval letters expire; we schedule inspections/title early so we can close inside the window.

Short sale vs. deed-in-lieu vs. loan mod

-

Short sale: You sell to a third party; may get a deficiency waiver; typically better for marketable homes.

-

Deed-in-lieu: You give the deed to the lender; fewer moving parts but usually after a failed short sale or when marketing isn’t practical.

-

Loan modification/forbearance: Keep the home with changed terms—best if your hardship is temporary and you can afford the modified payment.

Hardship letter template (copy/paste)

Re: Short Sale Request for [Your Address], Loan #[####]

Dear Loss Mitigation Team,

I am requesting your approval for a short sale due to [brief hardship: job loss/reduction, medical expenses, divorce, death in family, relocation, payment increase, etc.].

Since [date], my monthly income has decreased from $____ to $____, while essential expenses have increased to $____. Despite cutting costs and exploring options, I can no longer maintain the mortgage payment of $____ and am unable to bring the loan current.

We have listed the property at market value and accepted an offer of $____, which aligns with current sales for similar homes. After normal closing costs, the net proceeds will be $____, which is less than the amount owed.

I respectfully request short-sale approval and a waiver of any deficiency so I can resolve this debt responsibly and avoid foreclosure. I appreciate your consideration and have attached the requested financial documents.

Sincerely,

[Your Name]

[Phone] • [Email]

Frequently asked questions

Will the lender automatically waive the deficiency?

Not automatically. Ask for it in writing in the approval letter. If they won’t waive, they may request a small contribution or a promissory note—we’ll negotiate.

Can I get relocation assistance?

Sometimes. Programs change, but individual lenders may offer move-out assistance when it saves them time/money. It never hurts to ask.

Do I owe taxes on forgiven debt?

Possibly. Lenders may issue a 1099-C for canceled debt. There are potential exclusions for primary residences under federal law (which evolve). Talk to a CPA about your eligibility.

How long does this take?

From accepted offer to approval, 4–12+ weeks is common. The cleaner your file (all liens disclosed, full documents), the faster it goes.

Bottom line

A short sale is a structured exit that can protect your credit, your sanity, and sometimes your wallet—if you plan it well and negotiate the terms (especially the deficiency waiver) in writing. The key is early action, complete documentation, and working with people who’ve done this before.

Want a confidential strategy call?

I’ll run your market value + net sheet, outline your lender’s short-sale checklist, and help you draft a hardship packet—

so you know exactly what to expect and how to move forward.

Lesley Perreault

REAL Broker, LLC.

316-202-5515

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "