What Happens If your Wichita Home Doesn't Appraise? 7 Ways Sellers Can Save The Deal

Low Appraisal? 7 Ways Sellers Can Save the Deal

A Wichita seller’s playbook for keeping your price, your buyer, and your sanity (mostly).

When an appraisal lands below contract price, it doesn’t have to tank your sale or your net. Use this step-by-step plan to challenge the value, strengthen the file, or re-structure terms so you still close on time.

1) File a Reconsideration of Value (ROV)—fast

Ask the buyer’s lender- through your listing agent... ME :) - to open an ROV. I will submit a packet:

-

3–5 superior comps (closed recently, closest in size/age/condition; same school district; similar lot/location features).

-

Update sheet with dates/costs (roof/HVAC/windows, kitchen/bath, permits).

-

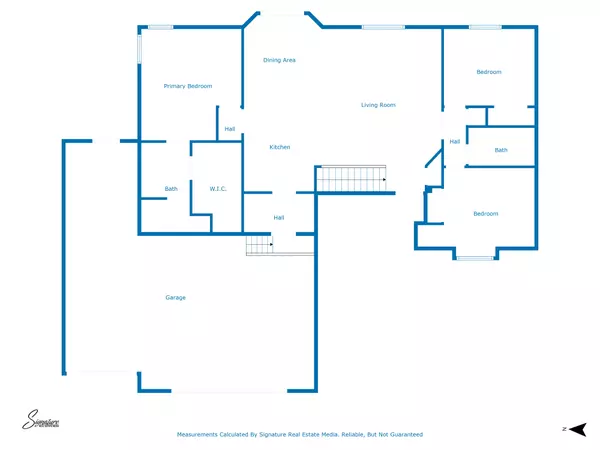

Facts the appraiser missed (finished-basement SF, third garage bay, lake/greenbelt, cul-de-sac, etc.).

-

Photos/receipts for condition items that impact value.

VA loans have a formal Tidewater process before the appraiser finalizes value; FHA/VA/Conventional each have lender-specific ROV procedures. I will work with the buyer’s loan officer to coordinate this.

My Seller at 801 N. Custer just met appraisal using this process!!!

2) Audit the report for errors (they happen)

Common appraisal missteps that are fixable:

-

Wrong GLA (gross living area), missed finished basement or egress bedroom.

-

Quality/condition rated too low relative to comps.

-

Inaccurate lot size, view (backs to green space vs. busy road), or garage count.

-

Bracketing issues: appraiser used inferior comps lacking your key features (walk-out, 3-car, lake view).

Flag the specifics in writing and include proof; ask the lender to forward with your ROV.

3) Provide better comps (not just “nearby”)

Curate, don’t dump:

-

Prefer ≤ 0.5–1.0 mile, ≤ 90–180 days, similar style/age/size (±10%).

-

If the market moved up after older comps, show time adjustments with MLS stats.

-

Include paired sales to support big adjustments (3-car vs 2-car, lake vs interior, walk-out vs garden).

-

Exclude sales with heavy concessions that inflated contract prices.

4) Restructure the deal instead of cutting price

If value holds after ROV, keep your net with smarter math:

-

Gap share: Buyer covers first $X of the shortfall; you meet in the middle.

-

Reduce/withdraw seller credits so the buyer can put more cash toward the gap.

-

Tighten timelines (shorter inspection/financing) or add a rent-back—non-price “wins” that preserve your bottom line.

-

Personal property can’t count toward appraised value, but you can negotiate it separately to sweeten terms.

Example: Contract $350k, appraisal $342k → $8k shortfall. Buyer covers $5k, you drop $3k, remove a $2k closing credit you’d offered. Net impact to you: $1k, not $8k.

5) Consider a desk/field review or a new appraisal

-

Lenders can order an internal review if the report looks weak.

-

Switching lenders may trigger a new appraisal on conventional loans.

-

FHA/VA appraisals often follow the property for a period; rules vary and can change—coordinate with the buyer’s loan officer before making moves.

(Bottom line: I will talk to the lender first; don’t guess.)

6) Solve condition flags that depress value

If the report cites “subject-to” repairs or Condition/Quality issues:

-

Knock out the list (peeling paint, GFCIs, handrails, roof tune-up), send receipts, and request re-inspection.

-

A cleaner condition rating can lift value or at least keep lending on track.

7) Know when to pivot price—and protect your net

If the data truly supports the appraised number:

-

Drop to the nearest search bracket (e.g., $350,000 → $349,900 or $340,000 → $339,900) to unlock a new buyer pool.

-

Pair the reduction with fresh lead photo, headline, and a weekend open-house push to regain momentum.

72-Hour Appraisal Playbook

Day 0 (Same Day): Get the full report. Agent + lender huddle. Start ROV request.

Day 1: Build packet (comps, updates, error list, photos). Submit to lender.

Day 2–3: Negotiate structure (gap share, credits, timelines) while ROV is in flight.

Day 3–5: If ROV succeeds → amend contract. If not → execute your plan B (gap share, lender review, or bracket price reset).

A low appraisal is a solvable problem. Lead with facts (ROV), clarity (error audit), and structure (gap/share & credits)—and keep the conversation moving through the lender. Most “low” appraisals can be cured without giving away the farm.

Want my expert help navigating your next home sale or purchase? Call me at 316-202-5515

Lesley Perreault, REAL Broker LLC.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "